MEAC DNS Study: Difference between revisions

Dustin Loup (talk | contribs) No edit summary |

|||

| (29 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

{{Resource | |||

|Organization=ICANN | |||

|Type=Study | |||

|Issue=DNS | |||

|Release Date=2016/01/25 | |||

|Link=https://www.icann.org/en/system/files/files/meac-dns-study-26feb16-en.pdf | |||

}} | |||

'''The Middle East and Adjoining Countries (MEAC) DNS Study 2015''' analyzes the MEAC region's domain name industry and registration data as it relates to the larger global internet environment. MEAC contains a structured survey of ccTLD registries in the region, supplemented with interviews with registries and registrars, and also offers suggested actions to stimulate wider uptake in the region.<ref name="study">[https://www.icann.org/en/system/files/files/eurid-middle-east-dns-study-initial-13oct15-en.pdf MEAC DNS Study], ICANN.org. Published 2015 October 13. Retrieved 2015 November 6.</ref> | '''The Middle East and Adjoining Countries (MEAC) DNS Study 2015''' analyzes the MEAC region's domain name industry and registration data as it relates to the larger global internet environment. MEAC contains a structured survey of ccTLD registries in the region, supplemented with interviews with registries and registrars, and also offers suggested actions to stimulate wider uptake in the region.<ref name="study">[https://www.icann.org/en/system/files/files/eurid-middle-east-dns-study-initial-13oct15-en.pdf MEAC DNS Study], ICANN.org. Published 2015 October 13. Retrieved 2015 November 6.</ref> | ||

The recommendation to conduct this study was one of the outcomes of the [[Middle East Engagement Strategy]], which was developed by a group of community members in the region, and defined three strategic focus areas for the region. One of those focus areas, which was to develop the region's domain name industry, is covered by this study.<ref name="icann">[https://www.icann.org/news/announcement-2-2015-03-16-en Request for Proposal: DNS Study for the Middle East and Adjoining Countries], ICANN.org. Retrieved 2015 November 6.</ref> | The recommendation to conduct this study was one of the outcomes of the [[Middle East Engagement Strategy]], which was developed by a group of community members in the region, and defined three strategic focus areas for the region. One of those focus areas, which was to develop the region's domain name industry, is covered by this study.<ref name="icann">[https://www.icann.org/news/announcement-2-2015-03-16-en Request for Proposal: DNS Study for the Middle East and Adjoining Countries], ICANN.org. Retrieved 2015 November 6.</ref><ref name="icann2">[https://www.icann.org/news/blog/the-middle-east-strategy-two-years-later The Middle East Strategy: Two Years Later], ICANN.org. Published 2015 July 7. Retrieved 2015 November 17.</ref> | ||

[[ICANN]] first called for proposals for the study in March 2015, and requested that reports be submitted no later than October 9th.<ref name="icann"></ref> In June 2015, the [[.eu]] [[registry]], [[EURid]], was selected by [[ICANN]] to conduct the study.<ref name="eurid">[https://www.eurid.eu/en/news/jun-2015/eurid-selected-icann-develop-dns-study-middle-east-and-adjoining-countries EURid selected by ICANN to develop DNS study in the Middle East and adjoining countries], EURid.org. Published 2015 June 15. Retrieved 2015 November 6.</ref> | [[ICANN]] first called for proposals for the study in March 2015, and requested that reports be submitted no later than October 9th.<ref name="icann"></ref> In June 2015, the [[.eu]] [[registry]], [[EURid]], was selected by [[ICANN]] to conduct the study.<ref name="eurid">[https://www.eurid.eu/en/news/jun-2015/eurid-selected-icann-develop-dns-study-middle-east-and-adjoining-countries EURid selected by ICANN to develop DNS study in the Middle East and adjoining countries], EURid.org. Published 2015 June 15. Retrieved 2015 November 6.</ref> | ||

| Line 8: | Line 15: | ||

* Across the region as a whole, 31% of users spend 3 hours or fewer per day online, but in some countries, people said they are online for more than 10 hours per day. Pakistan had the lowest median hours per day at 3 hours; Qatar and UAE had the highest, at 10 hours. | * Across the region as a whole, 31% of users spend 3 hours or fewer per day online, but in some countries, people said they are online for more than 10 hours per day. Pakistan had the lowest median hours per day at 3 hours; Qatar and UAE had the highest, at 10 hours. | ||

* Users have a strong preference for websites using local languages such as Arabic, Farsi, and Urdu when interacting with friends and government online, but English dominates the language of web content, with 71% of sites associated with the region (compared to 55% of global sites). They also prefer to purchase from local registrars over foreign ones.<ref name="study"></ref> | * Users have a strong preference for websites using local languages such as Arabic, Farsi, and Urdu when interacting with friends and government online, but English dominates the language of web content, with 71% of sites associated with the region (compared to 55% of global sites). They also prefer to purchase from local registrars over foreign ones.<ref name="study"></ref> | ||

* Social media is on the uptake in the region, perhaps because difficulties in domain name registration make social media a faster channel to get online. According to the 2014 Arab Social Media Report, there are 81 million Facebook users and 6 million Twitter users in the Arab world, and use of social media is growing rapidly.<ref name="arabsocialmedia">[http://www.mbrsg.ae/HOME/PUBLICATIONS/Research-Report-Research-Paper-White-Paper/Citizen-Engagement-and-Public-Services-in-the-Arab.aspx The Arab Social Media Report- Edition #6], MBRSG.ae. Published 2014 June. Retrieved 2015 November 7.</ref> | * Social media is on the uptake in the region, perhaps because difficulties in domain name registration make social media a faster channel to get online. According to the 2014 [[Arab Social Media Report]], there are 81 million Facebook users and 6 million Twitter users in the Arab world, and use of social media is growing rapidly.<ref name="arabsocialmedia">[http://www.mbrsg.ae/HOME/PUBLICATIONS/Research-Report-Research-Paper-White-Paper/Citizen-Engagement-and-Public-Services-in-the-Arab.aspx The Arab Social Media Report- Edition #6], MBRSG.ae. Published 2014 June. Retrieved 2015 November 7.</ref> | ||

* The average annual percentage growth rate is higher than that experienced in the rest of the world, where growth rates are tending to flatten. The number of domains per 1,000 of population (ie: 9.6 domains per in Iran and 3 per in Tunisia) indicates that the region has low domain name penetration compared with other countries. The high percentage growth could be sign of a healthy market with potential growth to come, or low numbers could merely result in a large percentage of growth. | * The average annual percentage growth rate is higher than that experienced in the rest of the world, where growth rates are tending to flatten. The number of domains per 1,000 of population (ie: 9.6 domains per in Iran and 3 per in Tunisia) indicates that the region has low domain name penetration compared with other countries. The high percentage growth could be sign of a healthy market with potential growth to come, or low numbers could merely result in a large percentage of growth. | ||

* 63% of users surveyed tended to use the Internet for social reasons, rather than for business reasons, which only accounted for 37% of those polled.<ref name="study"></ref> | * 63% of users surveyed tended to use the Internet for social reasons, rather than for business reasons, which only accounted for 37% of those polled.<ref name="study"></ref> | ||

==Recommendations== | ==Recommendations== | ||

* Basic internet access issues need to be given priority. Local hosting markets must be strengthened. | '''For the General Internet Ecosystem'''<ref name="study"></ref> | ||

* Policies and investment should focus on supporting eCommerce | * Basic internet access issues need to be given priority. | ||

* Local TLD operators should liberalize policies, by making them more accessible, lowering fees, and making policies more transparent. | * Local hosting markets must be strengthened. [[ISOC]]'s [[Local Content Report]] dictates that there is a strong correlation between the development of network infrastructure and the growth of local content.<ref name="oecd">[http://www.oecd.org/internet/ieconomy/50305352.pdf The Relationship Between Local Content, Internet Development, and Access Prices], OECD.org.</ref> | ||

* | * Enhancing local language content will benefit the 50% of users who prefer to use local languages online. | ||

* Policies and investment should focus on supporting eCommerce. | |||

'''For the Domain Name Markets'''<ref name="study"></ref> | |||

* Local TLD operators should liberalize policies, by making them more accessible, lowering fees, and making policies more transparent. | |||

* Standardizing technical and operational systems will reduce costs and encourage international registrars to support the region, which is essential to long-term growth. Developed local Internet markets tend to report lower international prices for bandwidth and vice versa: markets with more intense international Internet traffic tend to report lower local prices for Internet access.<ref name="oecd"></ref> | |||

* International registrars can intensify local competition by lowering retail prices and improving uptake. | * International registrars can intensify local competition by lowering retail prices and improving uptake. | ||

* [[ccTLD]]s in the region should consider starter | * [[ccTLD]]s in the region should consider starter programs and incentives to on-board new registrars at local level. | ||

* Registries may also consider bundling domain names with add-on products such as forwarding services and services that assist customers in building websites.<ref name="study"></ref> | * Registries may also consider bundling domain names with add-on products such as forwarding services and services that assist customers in building websites.<ref name="study"></ref> | ||

* Setting regional benchmarks for TLD development, following the model of worldwide [[ccTLD]]s such as [[EURid]], could be very helpful. Positive case studies include [[.no]] and [[.eu]]. | * Setting regional benchmarks for TLD development, following the model of worldwide [[ccTLD]]s such as [[EURid]], could be very helpful. Positive case studies include [[.no]] and [[.eu]]. | ||

==Domain Name Industry & Usage== | ==Domain Name Industry & Usage== | ||

| Line 31: | Line 43: | ||

* End user awareness about internet domain names was quite high; nearly half the users surveyed knew what a domain name is. 40% typed domains directly into the navigation bar of their browser (compared with 35 % of global users), and nearly all users from the region check the domain name before clicking search results.<ref name="study"></ref> | * End user awareness about internet domain names was quite high; nearly half the users surveyed knew what a domain name is. 40% typed domains directly into the navigation bar of their browser (compared with 35 % of global users), and nearly all users from the region check the domain name before clicking search results.<ref name="study"></ref> | ||

* Most MEAC TLDs have been available since the early '90s, but growth is not a high priority. Most do little to no promotion and only four -- [[.ae]], [[.af]], [[.pk]] and [[.qa]] -- operate with any commercial focus.<ref name="study"></ref> | * Most MEAC TLDs have been available since the early '90s, but growth is not a high priority. Most do little to no promotion and only four -- [[.ae]], [[.af]], [[.pk]] and [[.qa]] -- operate with any commercial focus.<ref name="study"></ref> | ||

* Of the thirteen registries in the region, two who that the most domain names are [[MarkMonitor]] and [[Corporation Service Company]], two American entities that focus primarily on business clientele. The other eleven registrars are focused on individual registrants, and do not offer the same variety of domain names as their business-oriented counterparts.<ref name="study"></ref> | * Of the thirteen registries in the region, two who that the most domain names are [[MarkMonitor]] and [[Corporation Service Company]], two American entities that focus primarily on business clientele. The other eleven registrars are focused on individual registrants, and do not offer the same variety of domain names as their business-oriented counterparts.<ref name="study"></ref> | ||

* The study measured the content of 1.1 million sites associated with the region; it found that 300,000 were hosted outside the region and 830,000 were hosted in the region. | * The study measured the content of 1.1 million sites associated with the region; it found that 300,000 were hosted outside the region and 830,000 were hosted in the region. | ||

<br /> | |||

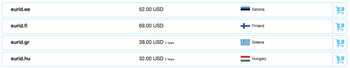

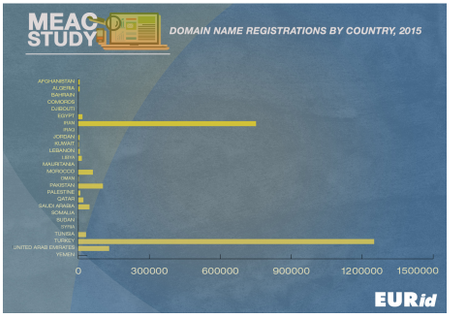

'''Domain Name Registration by Country, 2015'''<ref name="infographics">[https://community.icann.org/download/attachments/56142559/Infographic.pdf?version=1&modificationDate=1444660535000&api=v2 MEAC DNS Study - Infographics], ICANN.org. Retrieved 2015 November 13.</ref> | |||

[[Image:MEAC-Domain-Name-Registration.png|Middle East and Adjoining Countries Domain Name Registrations by Country|450px]] | |||

<br /><br /> | |||

'''Full Sites vs. Parked Sites in MEAC and Beyond'''<ref name="study"></ref> | '''Full Sites vs. Parked Sites in MEAC and Beyond'''<ref name="study"></ref> | ||

{| class="wikitable sortable" | {| class="wikitable sortable" | ||

| Line 79: | Line 94: | ||

|- | |- | ||

|} | |} | ||

<br /> | |||

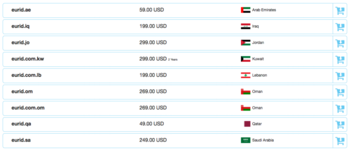

'''Comparative TLD Pricings in Africa, Europe, and MEAC Regions'''<br /> | |||

Some registries charge what [[Janelle McAlister]] of [[MarkMonitor]] calls "unreasonable" prices, sometimes well over $100 USD and as high as $200 USD -- even if most were in the range of $35 to $55 USD. The images below capture sample pricings as of September 2015.<ref name="study"></ref> | |||

<gallery widths="350px" heights="200px"> | |||

Image:africa-tld-pricing.png|'''Africa Region''' | |||

Image:europe-tld-pricing.png|'''Europe Region''' | |||

Image:meac-tld-pricing.png|'''MEAC Region''' | |||

</gallery> | |||

==MEAC Countries and the Socioeconomic Environment== | ==MEAC Countries and the Socioeconomic Environment== | ||

| Line 121: | Line 145: | ||

|- | |- | ||

| 66-89% | | 66-89% | ||

| | | Egypt, United Arab Emirates, Morocco, Tunisia, Iran | ||

|- | |- | ||

| 90% + (high ranking) | | 90% + (high ranking) | ||

Latest revision as of 17:37, 13 December 2017

{{#cargo_store:_table=Resources|Organization=|Type=Study|Issue=DNS|Release_Date=2016/01/25|Link=https://www.icann.org/en/system/files/files/meac-dns-study-26feb16-en.pdf }}{|style="width: 25em; font-size: 100%; border: 1px solid #aaaaaa; background-color: #f9f9f9; color: black; margin-bottom: 0.5em; margin-left: 1em; padding: 0.2em; float: right; clear: right; text-align:left;" |Organization: |ICANN |- |Type: |Study |- ||Issue: |DNS |- |Release Date: |2016/01/25

|- ! Link | Link |}

The Middle East and Adjoining Countries (MEAC) DNS Study 2015 analyzes the MEAC region's domain name industry and registration data as it relates to the larger global internet environment. MEAC contains a structured survey of ccTLD registries in the region, supplemented with interviews with registries and registrars, and also offers suggested actions to stimulate wider uptake in the region.[1]

The recommendation to conduct this study was one of the outcomes of the Middle East Engagement Strategy, which was developed by a group of community members in the region, and defined three strategic focus areas for the region. One of those focus areas, which was to develop the region's domain name industry, is covered by this study.[2][3]

ICANN first called for proposals for the study in March 2015, and requested that reports be submitted no later than October 9th.[2] In June 2015, the .eu registry, EURid, was selected by ICANN to conduct the study.[4]

General Findings[edit | edit source]

- Across the region as a whole, 31% of users spend 3 hours or fewer per day online, but in some countries, people said they are online for more than 10 hours per day. Pakistan had the lowest median hours per day at 3 hours; Qatar and UAE had the highest, at 10 hours.

- Users have a strong preference for websites using local languages such as Arabic, Farsi, and Urdu when interacting with friends and government online, but English dominates the language of web content, with 71% of sites associated with the region (compared to 55% of global sites). They also prefer to purchase from local registrars over foreign ones.[1]

- Social media is on the uptake in the region, perhaps because difficulties in domain name registration make social media a faster channel to get online. According to the 2014 Arab Social Media Report, there are 81 million Facebook users and 6 million Twitter users in the Arab world, and use of social media is growing rapidly.[5]

- The average annual percentage growth rate is higher than that experienced in the rest of the world, where growth rates are tending to flatten. The number of domains per 1,000 of population (ie: 9.6 domains per in Iran and 3 per in Tunisia) indicates that the region has low domain name penetration compared with other countries. The high percentage growth could be sign of a healthy market with potential growth to come, or low numbers could merely result in a large percentage of growth.

- 63% of users surveyed tended to use the Internet for social reasons, rather than for business reasons, which only accounted for 37% of those polled.[1]

Recommendations[edit | edit source]

For the General Internet Ecosystem[1]

- Basic internet access issues need to be given priority.

- Local hosting markets must be strengthened. ISOC's Local Content Report dictates that there is a strong correlation between the development of network infrastructure and the growth of local content.[6]

- Enhancing local language content will benefit the 50% of users who prefer to use local languages online.

- Policies and investment should focus on supporting eCommerce.

For the Domain Name Markets[1]

- Local TLD operators should liberalize policies, by making them more accessible, lowering fees, and making policies more transparent.

- Standardizing technical and operational systems will reduce costs and encourage international registrars to support the region, which is essential to long-term growth. Developed local Internet markets tend to report lower international prices for bandwidth and vice versa: markets with more intense international Internet traffic tend to report lower local prices for Internet access.[6]

- International registrars can intensify local competition by lowering retail prices and improving uptake.

- ccTLDs in the region should consider starter programs and incentives to on-board new registrars at local level.

- Registries may also consider bundling domain names with add-on products such as forwarding services and services that assist customers in building websites.[1]

- Setting regional benchmarks for TLD development, following the model of worldwide ccTLDs such as EURid, could be very helpful. Positive case studies include .no and .eu.

Domain Name Industry & Usage[edit | edit source]

- Only 1% of the world's registered domains are in the MEAC region. Only 3 ccTLDs in the region have higher than 10 domains per 1,000 inhabitants, which compares to 100-300 domains per 1,000 in other countries worldwide.[1]

- Annual growth in domain name registrations is strong, at >20% per year. Growth is particularly strong in ccTLDs that have deregulated, such as .tn and .ma.

- There are 21,000 IDNs in the region, half of which are under .tr and half which are Arabic script -- but in general, uptake of IDNs is hampered by lack of universal acceptance.[1]

- Hosting markets are strongly linked to domain name registration, and hosting across the region is weak, with the exception of Iran and Turkey. Only 5% of popular web content is hosted in the region, and many countries have strict legislation affecting internet content.[1]

- Most international registrars who have modern platforms for end-users are not present in the region and are discouraged from involvement due to administrative barriers to registering domain names in the region, such as manual procedures or pre-registration checks, which make changes difficult and are not equipped to meet high industry demands.[1]

- Most ccTLDs in the region are confined to their territory and have strict policies for registrar accreditation and domain name registration, which may limit growth.[1]

- End user awareness about internet domain names was quite high; nearly half the users surveyed knew what a domain name is. 40% typed domains directly into the navigation bar of their browser (compared with 35 % of global users), and nearly all users from the region check the domain name before clicking search results.[1]

- Most MEAC TLDs have been available since the early '90s, but growth is not a high priority. Most do little to no promotion and only four -- .ae, .af, .pk and .qa -- operate with any commercial focus.[1]

- Of the thirteen registries in the region, two who that the most domain names are MarkMonitor and Corporation Service Company, two American entities that focus primarily on business clientele. The other eleven registrars are focused on individual registrants, and do not offer the same variety of domain names as their business-oriented counterparts.[1]

- The study measured the content of 1.1 million sites associated with the region; it found that 300,000 were hosted outside the region and 830,000 were hosted in the region.

Domain Name Registration by Country, 2015[7]

Full Sites vs. Parked Sites in MEAC and Beyond[1]

| Country | Number of Sites | Percentage Full Sites | Percentage Parked Sites |

|---|---|---|---|

| Turkey | 754,805 | 72% | 27% |

| United States | 186,218 | 72% | 28% |

| Germany | 31,432 | 85% | 14% |

| Hong Kong | 23,576 | 83% | 17% |

| Total (In Region) | 831,010 | 68% | 32% |

| Total (In Region) | 318,958 | 79% | 21% |

| Grand Total | 1,149,968 | 71% | 29% |

Comparative TLD Pricings in Africa, Europe, and MEAC Regions

Some registries charge what Janelle McAlister of MarkMonitor calls "unreasonable" prices, sometimes well over $100 USD and as high as $200 USD -- even if most were in the range of $35 to $55 USD. The images below capture sample pricings as of September 2015.[1]

-

Africa Region

-

Europe Region

-

MEAC Region

MEAC Countries and the Socioeconomic Environment[edit | edit source]

The region covered in the MEAC Study covers a large geographic expanse, from the Atlantic coast in the West to the Hindu Kush in the East. Linguistic diversity includes several languages sharing Arabic script, such as Arabic, Urdu, Farsi, Dari, Pashto), and others (such as Turkish) written in Latin script.[2]

At the request of ICANN, the MEAC DNS Study focuses deeply on the following countries: Afghanistan, Egypt, Iran, Jordan, Lebanon, Morocco, Pakistan, Saudi Arabia, Tunisia, Turkey, Qatar, and United Arab Emirates. The online population across the region varies greatly, from as low as 6% in Afghanistan) to 88% in United Arab Emirates.[1]

Economic Differences[edit | edit source]

Across all the economic measures, Gulf countries score most highly, Afghanistan consistently ranks lowest.[1]

| GDP per capita range | Countries or territories |

|---|---|

| < $999 (lowest) | Afghanistan |

| $ 1,000-$3,999 (lower middle) | Egypt, Morocco, Pakistan |

| $ 4,000-$19,999 (upper middle) | Iran, Jordan, Lebanon, Tunisia, Turkey |

| > $20,000 (high) | Qatar, Saudi Arabia, United Arab Emirates |

Languages and Literacy Rates[edit | edit source]

Literacy rates are essential for participation in internet usage. Countries like Afghanistan and Pakistan may face greater challenges in getting its population online than countries with higher literacy levels, such as Jordan and Lebanon.[1][8]

| Literacy (secondary+) | Country |

|---|---|

| 0-33% (low ranking) | Afghanistan |

| 34-65% | Pakistan |

| 66-89% | Egypt, United Arab Emirates, Morocco, Tunisia, Iran |

| 90% + (high ranking) | Qatar, Saudi Arabia, Jordan, Lebanon, Turkey |

Linguistic and Cultural Homogeneity[edit | edit source]

High linguistic and cultural homogeneity result in high instances of local language web content, which in turn is a good marker of local domain name uptake in associated countries. It can be projected that countries like Egypt, Iran, Jordan, Morocco, and Turkey will thrive in local internet content growth more than countries with a more diverse population base and high percentage of migrant workers, such as UAE or Qatar. Possible distorting factors, however, include international sanctions or local laws which bar local applications from being available.[1]

Linguistic homogeneity is defined by the percentage of population speaking national language at home, according to statistics queried from Ethnologue,[9] and cultural homogeneity comes from UNESCO's 2009 World Report on Cultural Diversity 2009.[10]

| Country | Linguistic Homogeneity | Cultural Homogeneity | Local Language Content |

|---|---|---|---|

| Egypt | High | High | 60% |

| Iran | High | Medium | 80% |

| Morocco | High | High | 60% |

| Turkey | High | High | 65% |

| Saudi Arabia | Medium | Medium | 45% |

| Pakistan | Medium | Low | 35% |

| Afghanistan | -- | Medium | 30% |

| United Arab Emirates | Low | Low | 15% |

| Qatar | Low | Low | 20% |

Research Methodology[edit | edit source]

The data presented in the MEAC DNS Study was gathered from a combination of:[1]

- A specially-commissioned multi-country user survey

- Direct contact with ccTLD registries and registrars

- Data analysis of gTLD open zone files

Multi-Country User Survey[edit | edit source]

The users surveys were conducted in English, French, and Arabic, through a mixture of online forms and telephone interviews, and were administered by local companies and partners. 702 respondents from 15 countries in the MEAC region answered 24 questions about the use of online payment systems, online activities, and preferred languages. Though the sample size was large enough to draw tentative conclusions across the region as a whole, the small number of individuals per country does potentially distort results, as large shifts in percentage may come from relatively small movements of numbers.[1]

92% of the responses were received from those within the age ranges of 15-44, with ages 45 and upward less well-represented with only 8%, which may perhaps reflect the young population of countries in the region and the slow uptake of web usage amongst older generations. Users were asked to identify themselves by internet governance categories such as "government, private sector, civil society, academic or technical community", but responses revealed that people did not understand these categories.[1]

ccTLD Registries and Registrars[edit | edit source]

ccTLDs in countries like Iran, Morocco, and Tunisia publicly publish their registration data, yet many of their statistics have only figures on the day consulted and lack historic or IDN data. Other registries in the region do not publish any statistics. Therefore, the MEAC DNS Study team, used existing resources and contacts from their ten-plus years of work in the ccTLD and IDN space. This included a long-term project called the EURid-UNESCO World Report on Internationalised Domain Names, as well as work with organizations like CENTR, LACTLD and APTLD. Therefore, the MEAC DNS Study benefit from these contacts; all ccTLD registration data in the study, including IDN data, either results from direct registry contact between June and September 2015, or from publicly available information from registry websites.[1]

gTLD Open Zone Files[edit | edit source]

Entire Data Set

All gTLD and open zone file domains were captured in June 2015, producing about 156 million entries. For privacy purposes, the team avoided doing large-scale WHOIS lookups, and supplemented them only when unavoidable. They recorded the following metrics for each domain name:[1]

- IP address of the domain name

- Web page status code for the domain

- Script of the domain name itself

- Scripts contained in the web page for the domain where content exists in the web page status code for the domain

- Geographical location of hosting for each domain name using the IP address and a lookup database - recording country, region and city for each

Identifying privacy/proxy registrations in the region was a large challenge, because hosting and registrant data are not guaranteed to be region-based. The team worked from a list of 500 popular websites and identified 4,832 unique domain names. They then gathered data through Alexa.com, performing WHOIS lookups to identify use of privacy proxy, country of hosting, website status and registrar of record. [1]

Regional Subset

For any domains that match one or more of the following criteria, a regional subset was produced:[1]

- Country of hosting the webpage was within the region

- The script of the domain name itself contains Arabic characters

- The content of the webpage contained Arabic characters

Arabic Subset

Many domains encountered in the subset produced only contained a small number of Arabic characters, so a further subset was created with those domains where at least 50 Arabic characters occurred on the webpage. These domains were checked to see if their HTML language attributes were set for one of the regional languages.[1]

References[edit | edit source]

- ↑ 1.00 1.01 1.02 1.03 1.04 1.05 1.06 1.07 1.08 1.09 1.10 1.11 1.12 1.13 1.14 1.15 1.16 1.17 1.18 1.19 1.20 1.21 1.22 1.23 1.24 1.25 1.26 1.27 MEAC DNS Study, ICANN.org. Published 2015 October 13. Retrieved 2015 November 6.

- ↑ 2.0 2.1 2.2 Request for Proposal: DNS Study for the Middle East and Adjoining Countries, ICANN.org. Retrieved 2015 November 6.

- ↑ The Middle East Strategy: Two Years Later, ICANN.org. Published 2015 July 7. Retrieved 2015 November 17.

- ↑ EURid selected by ICANN to develop DNS study in the Middle East and adjoining countries, EURid.org. Published 2015 June 15. Retrieved 2015 November 6.

- ↑ 6.0 6.1 The Relationship Between Local Content, Internet Development, and Access Prices, OECD.org.

- ↑ MEAC DNS Study - Infographics, ICANN.org. Retrieved 2015 November 13.

- ↑ GDP per capita (current US$), WorldBank.org. Retrieved 2015 November 7.

- ↑ Ethnologue, Ethnologue.com. Retrieved 2015 November 7.

- ↑ Investing in Cultural Diversity and Intercultural Dialogue, UNESCO.org. Published 2009. Retrieved 2015 November 7.

External Links[edit | edit source]

- MEAC DNS Study - Draft Report, ICANN.org.

- MEAC DNS Study - Infographics, ICANN.org.